What Exactly is Under insurance?

You put everything into your operation. Long hours, careful planning, and the kind of work ethic most people wouldn’t last a day keeping up with. But what happens when the coverage you thought would protect it all falls short when you need it most?

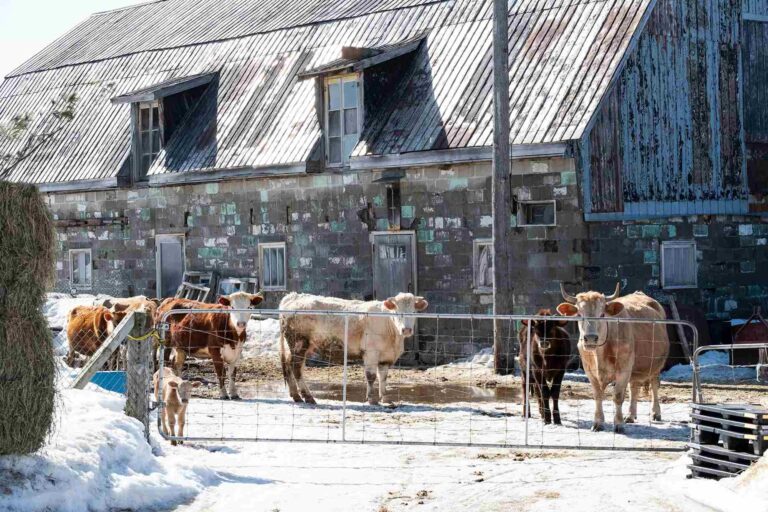

Let’s say you run a state-of-the-art cattle handling facility… top-tier equipment, routine updates, a setup you take pride in. Then, disaster strikes; a fire takes it all down. When you call your insurance company, you expect full compensation. Instead, the adjuster tells you your facility is classified as a commercial building, not a farm structure. That single misclassification cuts your payout down to a fraction of what you actually lost.

Why? Because your agent never asked the right questions, never updated your policy to reflect the real value of your investment, and never told you that your coverage didn’t match the reality of your operation.

Now you’re left picking up the pieces. With less than what you need to rebuild.

That is underinsurance.

Underinsurance occurs when your coverage doesn’t match the true value of your assets or potential risks.

How Underinsurance Hurts Ranchers and Beef Farmers

Insurance should work for you, not against you. But too often, agents don’t know what they don’t know—and that ignorance leaves you holding the short end of the stick when things go south.

You run a beef operation. You don’t insure your herd because you sell them off at nine months. Then one winter, a storm rolls in, and half your cattle are lost before sunrise. You just lost your future income.

A flood takes out your feed supply, but the policy you signed doesn’t cover stored grain losses. Now you’re staring down a massive expense just to keep your herd fed.

Your processing equipment malfunctions, spoiling thousands of dollars in product overnight. But your policy only covers structural damage, not the product inside.

Underinsurance is the difference between bouncing back or struggling for years to recover.

We Walk Every Property

Insurance shouldn’t be built on assumptions. We believe in setting foot on every operation we insure—because no two ranches are the same.

Accurate Valuation

Your prized herd and equipment aren’t just things with numbers attached to them. We ensure every asset is valued correctly—because your bottom line depends on it.

Risk Assessment

Drones miss details. We don’t. Our team knows what to look for and catches risks before they become financial disasters.

Real Relationships

We visit your land, meet your family, and understand your operation. That’s how we do business.

Our Process: More Than Just a Policy

We don’t guess. We don’t cut corners. We build coverage that actually protects what you’ve worked for.

Initial Consultation

We ask the hard questions, not just the easy ones.

On-Site Visit

We walk your property, document what matters, and take notes on what most agents overlook.

Risk Evaluation

Multiple eyes, multiple perspectives—because your operation deserves more than a one-size-fits-all policy.

Coverage Recommendations

We don't just present options; we explain them, refine them, and push back if we think you're missing key protection.

Follow-Up

Your ranch evolves. Your policy should too. We reassess and adjust, keeping your coverage as up-to-date as your operation.

Get Covered the Right Way.

If your insurance agent hasn’t set foot on your land, they don’t know what they’re protecting. That’s not how we operate.

Let’s make sure your coverage matches the reality of your business—not just what’s written on paper.